Sub-Partner Operates a Profit Center

A President heads the Subsidiary, and the company is a Profit Center within the Partnership Enterprise. Management Control is the Board of Directors, and the President of the Subsidiary is a voting board member.

The Sub-Partner is required to have an expansion plan forecasted starting date of 6 to 12 months.

The Sub-Partners Profit Center, the existing Managing Principal, continues to operate their business, has access to Business Processing as a Service (BPaas) essential business application, legal consult, and Digital Marketing Services, and maintains 75% of Netprofit.

Sub-Partner has full access to Essential Business Application (EBA), a powerful full-service business enterprise application. The EBA network supports every Business Processing as a Service (BPaaS) and integrates collaborative departmental services.

Must be willing to accept Preferred Convertible restricted shares

Thank you for being so interested in the program; here are some details about the agreement. It helps to clarify the terms and conditions of the Sub-Partner Expansion Funding and Profit Sharing Platform.

The agreement

The Exchange value offered is up to 3 times the expansion plan funding required. The exchange is series D common preferred convertible stock converted into trading common to fund the Expansion Plan.

The incubation period is 12 to 18 months, and the stock has a holding period between 6 to 12 months.

Welcome to the Sub-Partner Expansion Funding and Profit Sharing Platform.

The primary conditions must be agreed upon:

Sub-Partnership must have an existing business with an expansion plan and working capital.

Here’s a summary of the key points:

- Exchange Value: The exchange value offered can be up to three times the funding required for the expansion plan. This means that the party investing receives stock with a value potentially three times their investment.

- Stock Conversion: The exchange involves Series D common preferred convertible stock, which can be converted into trading common stock to fund the expansion plan.

- Incubation Period: The incubation period lasts between 12 to 18 months. During this period, the partnership or subsidiary is expected to receive support and guidance for business development.

- Stock Holding Period: The stock acquired during this agreement has a holding period of 6 to 12 months, meaning it cannot be sold or transferred for that period.

- Partnership Requirements: Sub-partnerships must have an existing business with an expansion plan and a need for working capital to participate.

- Management Control: The merger can involve a transfer of management control, ranging from 51% to 100%, from the original owner to the partner or subsidiary.

- Profit Sharing: The subsidiary is expected to convert into a profit center with a split of 25% to IJJ Corporation’s profit, which should contribute positively to the overall financial performance of the business.

- Board of Directors: The Principal of the Sub-partnership is granted a seat on the Board of Directors during the incubation period, suggesting involvement in decision-making.

- Exit Strategy: The company will receive a block of Preferred convertible stock as part of the exit strategy. This stock may be valuable when the partnership or subsidiary leaves the incubation program.

- Autonomy for Original Owner: As a Board of Directors member, the original owner retains a level of autonomy over the operation, implying a say in the decision-making process.

It’s important to thoroughly review and understand the terms and conditions of this agreement, possibly with the assistance of legal and financial professionals, before entering into such a partnership

More Details are provided during the initial interview.

Regulators Greenlight BlockChain Future Implications

BlockChain is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

It is a compound of the words bit and coin. The white paper frequently uses the shorter coin. There is no uniform convention for bitcoin capitalization.

On 18 August 2008, the domain name “bitcoin.org” was registered. In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin.A Peer-to-Peer Electronic Cash System was posted.

Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown. In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block. Embedded in the coinbase of this block was the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

One of the first supporters, adopters, and contributors to bitcoin was the receiver of the first bitcoin transaction, programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world’s first bitcoin transaction. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.

In the early days, Nakamoto is estimated to have mined 1 million bitcoins. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation. Nakamoto subsequently disappeared from any involvement in bitcoin. Andresen stated he then sought to decentralize control, saying:

“So, if I get hit by a bus, it would be clear that the project would go on”

This left opportunity for controversy to develop over the future development path of bitcoin. The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John’s.

The EU Clarifies the Anti-Money Laundering Directive

BlockChain is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

It is a compound of the words bit and coin. The white paper frequently uses the shorter coin. There is no uniform convention for bitcoin capitalization.

On 18 August 2008, the domain name “bitcoin.org” was registered. In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin.A Peer-to-Peer Electronic Cash System was posted.

Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown. In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block. Embedded in the coinbase of this block was the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

One of the first supporters, adopters, and contributors to bitcoin was the receiver of the first bitcoin transaction, programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world’s first bitcoin transaction. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.

In the early days, Nakamoto is estimated to have mined 1 million bitcoins. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation. Nakamoto subsequently disappeared from any involvement in bitcoin. Andresen stated he then sought to decentralize control, saying:

“So, if I get hit by a bus, it would be clear that the project would go on”

This left opportunity for controversy to develop over the future development path of bitcoin. The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John’s.

Interpol to Increase Measures Against Crypto Laundering

BlockChain is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

It is a compound of the words bit and coin. The white paper frequently uses the shorter coin. There is no uniform convention for bitcoin capitalization.

On 18 August 2008, the domain name “bitcoin.org” was registered. In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin.A Peer-to-Peer Electronic Cash System was posted.

Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown. In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block. Embedded in the coinbase of this block was the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

One of the first supporters, adopters, and contributors to bitcoin was the receiver of the first bitcoin transaction, programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world’s first bitcoin transaction. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.

In the early days, Nakamoto is estimated to have mined 1 million bitcoins. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation. Nakamoto subsequently disappeared from any involvement in bitcoin. Andresen stated he then sought to decentralize control, saying:

“So, if I get hit by a bus, it would be clear that the project would go on”

This left opportunity for controversy to develop over the future development path of bitcoin. The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John’s.

US Proposes Virtual Currency-Specific Regulatory Body

BlockChain is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

It is a compound of the words bit and coin. The white paper frequently uses the shorter coin. There is no uniform convention for bitcoin capitalization.

On 18 August 2008, the domain name “bitcoin.org” was registered. In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin.A Peer-to-Peer Electronic Cash System was posted.

Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown. In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block. Embedded in the coinbase of this block was the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

One of the first supporters, adopters, and contributors to bitcoin was the receiver of the first bitcoin transaction, programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world’s first bitcoin transaction. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.

In the early days, Nakamoto is estimated to have mined 1 million bitcoins. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation. Nakamoto subsequently disappeared from any involvement in bitcoin. Andresen stated he then sought to decentralize control, saying:

“So, if I get hit by a bus, it would be clear that the project would go on”

This left opportunity for controversy to develop over the future development path of bitcoin. The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John’s.

Proof of Insurance to Be Added on the BlockChain Network

BlockChain is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a crypto currency wallet, most of them using bitcoin. The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008.

It is a compound of the words bit and coin. The white paper frequently uses the shorter coin. There is no uniform convention for bitcoin capitalization.

On 18 August 2008, the domain name “bitcoin.org” was registered. In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin.A Peer-to-Peer Electronic Cash System was posted.

Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown. In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block. Embedded in the coinbase of this block was the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

One of the first supporters, adopters, and contributors to bitcoin was the receiver of the first bitcoin transaction, programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world’s first bitcoin transaction. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.

In the early days, Nakamoto is estimated to have mined 1 million bitcoins. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation. Nakamoto subsequently disappeared from any involvement in bitcoin. Andresen stated he then sought to decentralize control, saying:

“So, if I get hit by a bus, it would be clear that the project would go on”

This left opportunity for controversy to develop over the future development path of bitcoin. The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John’s.

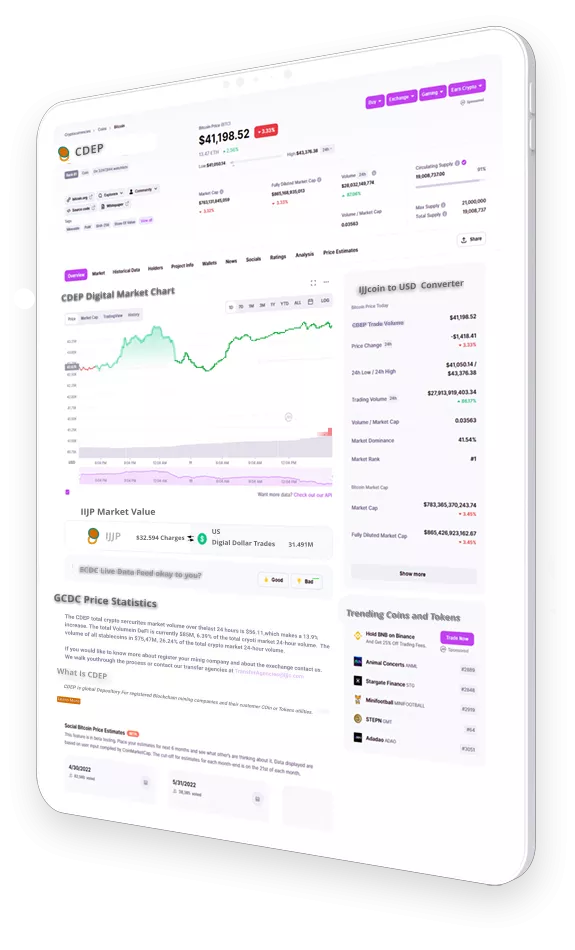

Clean house Crypto Coins and Tokens Secure within a Commission Depository Enterprise Platform Technology

CDEP is offering a worldwide moderation of Cryptocurrencies in security certificates. It is the first centralized digital currency system designed to simulate SEC DTCC and provide regulatory restrictions for Crypto coins and tokens for trading. The CDEP infrastructure commissions every crypto digital asset without changing the Cryptocurrency as a peer-to-peer trading transaction takes place between the Seller, broker, trading platform, and Buyer directly, with the transfer Agent registered companies as issuers. These transactions are verified by network nodes through the use of cryptography and recorded in a publicly distributed ledger called a registered CDEP blockchain member.

Crypto digital assets are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services.

Research produced by the University of Cambridge estimates that in 2022, over 300 million users will exchange cryptocurrency worldwide, most of them using crypto digital assets.

How did cryptocurrency become a reality?

On 18 August 2008, the domain name “bitcoin.org” was registered. In November of that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin. A Peer-to-Peer Electronic Cash System was posted.

Nakamoto implemented the Bitcoin software as open-source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown. In January 2009, the Bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the Genesis block.

Fast forward to the fourth quarter of 2024, slated for implementation before September, our core services will encompass the deployment and administration of a Centralized Depository to regulate cryptocurrency issuances globally. Additionally, we will incorporate certificates within the CDEP framework, serving as a secure journal for cryptocurrency transactions. We are also establishing a collaborative Sub-Partner team comprising selected Blockchain Mining companies specializing in Coins and Tokens.

Through these strategic partnerships, we aim to introduce their respective customer bases to the exciting value of trading the Crypto certificate world, which offers competitive equity volume trading opportunities to drive growth and innovation in the cryptocurrency market.